What is Bank Reconciliation?

Please note bank reconciliation in the software is completely optional and can be omitted if you prefer not to use this feature.

Bank reconciliation is the process where you can confirm that the Accounting Entries in the software match up with the activity and transactions in your bank account. An example of this would be confirming that an Accounting Entry for a $1000 rent payment matches up with a similar $1000 transaction in your bank account, that is to say it has been Reconciled. Until that point the Accounting Entry is considered Unreconciled. All Accounting Entries are Unreconciled by default as this means they haven’t yet been processed. They can then either be promoted to Reconciled or Discrepant, where Reconciled means that the Accounting Entry has a matching transaction in your bank account and where Discrepant means that there is an issue to be resolved.

** IMPORTANT TIP: The best way to quickly manage a lot of tenants and rents is through the Scheduled Accounting Entries system. Doing so saves a ton of time and effort and makes processing monthly often just as simple as clicking a button. It saves you all the effort of having to manually enter in all the data for each rent payment (as well as recurring expenses), it’s all automatically done for you. You can find more details by clicking here. That being said the challenge with bank reconciliation, at least when it comes to rents, is that your bank statement doesn’t include much information. For example if you have three rents each for $1000 outside of the date and amount, there isn’t much information to match each bank transaction to a specific tenant, even more so if some rent payments are combined because of cash payments. In any case the key is that you bank statement generally doesn’t include information such as which tenant it’s for, and for sure it doesn’t include which building it’s for, the category of the payment (Rent), when it was due, and so on. This is why you generally want to use Scheduled Entries to automate your rent collection to just a few clicks, and use the Reconciliation feature to confirm that everything matches up with your bank statements.

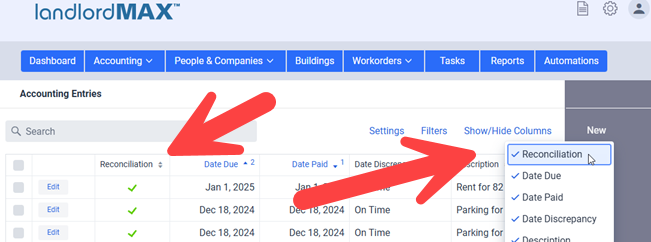

Display Bank Reconciliation Column

Depending on whether or not you’re using the bank reconciliation feature of the software, you can decide if you want to have the Reconciliation Status column displayed in the Accounting Entries table or not by selecting to Show/Hide the Reconciliation column as shown in the above screenshot.

When the Reconciliation column is enabled you will then see the Reconciliation Status column in the Accounting Entries table. By default it will be the first column (as well as the first menu item) but this can change depending on if you customize the columns and so on.

The Reconciliation status uses three different icons to display the status, a green checkmark for reconciled, a gray dash to indicate unreconciled, and a red x to indicate a discrepant entry. If you’re unsure of the icon you can always mouse over the column which will show a tooltip showing the wording rather than the status icon.

Reconciling an Accounting Entry

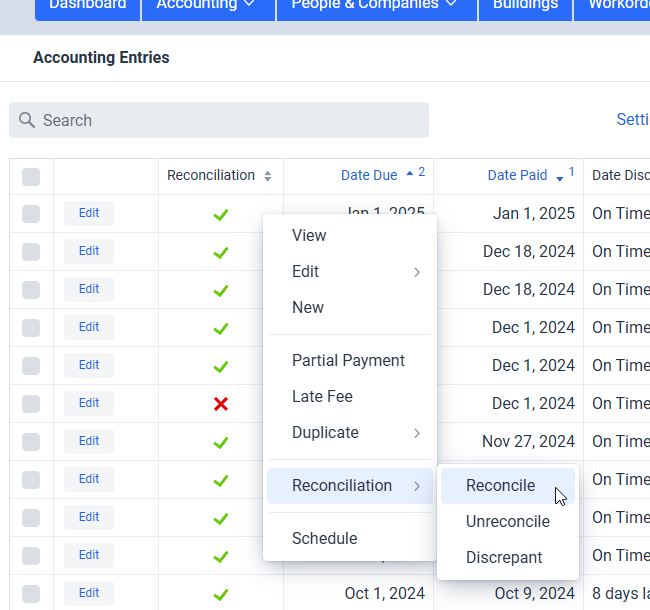

There are multiple ways to reconcile Accounting Entries. The first and simplest is to right-click on an Accounting Entry in the table and then select the Reconciliation status you want to update the entry to from the popup menu. This method will update the currently selected Accounting Entry. It’s equivalent to just editing that value in the entry but saves you some extra clicks as this is a more common action for those who use the bank reconciliation feature.

** IMPORTANT TIP: If you want to apply the same Reconciliation status to multiple Accounting Entries you can also select the checkboxes in the left column and then use the same right-click action and the selected Reconciliation Status will be applied to all the selected Accounting Entries. This is similar to using the Reconciliation action in the right menu.

In addition to the right-click action in the table, you can also reconcile using the right menu Reconciliation action button, editing the row in the table and changing the value manually, as well as manually editing the entry. However if you want to quickly and efficiently reconcile a lot of entries the easiest method is to use the right-click.

Filters and Searching

To simplify the process of reconciling your entries you can also apply filters which will limit the Accounting Entries you see to only those that match the selected Reconciliation filter. This can be very useful if for example you only want to see the Unreconciled entries so that you can work through reconciling them with your bank statement.

** TIP: Please note however that if you change the Reconciliation status of an entry that it will remain in the table until you refresh the table. This is intentional so that entries don’t seem to just disappear as you change their statuses, to help you keep track of what is happening. If you want to filter them out from the list just go ahead and refresh the page and the filters will be applied to them as well.

** IMPORTANT TIP: A quick reminder that if you set a Filter such as to only show Reconciled entries that you will need to clear the filter to once again see all the entries because filters are remembered, even if you refresh the page. You will need to clear the filter to see all the entries again.

Depending on your needs please note that you can also change the sorting order so that the entries are sorted by Reconciliation Status and so on.

** IMPORTANT TIP: Please note that searching for “reconciled” in the Search field also includes all the results for the “unreconciled” status as “reconciled” is part of the word “unreconciled”. If you want to show only reconciled entries then it is recommended to use the filters rather than searching for this.

Reporting

The software also provides you with a number of different Reconciliation reports in addition to the actions to the above. Specifically you can run reports for a specific Reconciliation Status all the way to grouping them by status, by account, by building, and so on. Generally it’s faster to use the Accounting Entries reconciliation features to reconcile them directly in the software with your bank statements, but some people still do prefer to do this with pen and paper (or highlighter and paper). In either case you can do both, so the option is up to you. You may also need to investigate some entries in more detail such as discrepant entries where having a report and/or printout can be very useful, in addition to listing the reconciled entries and so on.

There are approximately 25 Reconciliation related reports from the general reconciliation report, to reports for a specific status, to for a building, account, tenant, and so on, all the way to grouped by status, by account, by building, and so on.